Winning Requires Having a Growth Game Plan & Playbook

- Adam W.

- Nov 20, 2023

- 2 min read

Updated: Nov 21, 2023

In the realm of football, victory hinges on a meticulously crafted game plan and a playbook that equips the team to adapt seamlessly as the competition unfolds. A team arriving on game day with a divergent perspective on the game plan and without preparation for various game situations finds itself at a disadvantage, irrespective of individual talent.

Unfortunately, many companies harbor championship aspirations yet neglect the pivotal process of constructing a game plan and organizing a playbook for growth. Having collaborated with over 100 companies immersed in innovation-driven growth, a recurring pattern has materialized across the Fortune 500 to small and mid-size businesses—a passion for victory unaccompanied by the essential organizational foundation to compete effectively.

Consistent patterns emerge repeatedly. Stakeholders exhibit fervor for growth, take the requisite steps to foster an innovation-friendly environment, leverage political capital to allocate ample resources, and ensure growth permeates every facet of the organization. However, when growth falters, becomes non-repeatable, or is abandoned, stakeholders find themselves bewildered. The reason often lies in the absence of a comprehensive game plan and a robust playbook, essential tools to align investments and energy into winning strategies.

While the discourse on the significance of developing innovation portfolios and pipelines may sound cliché, it genuinely represents a fundamental and game-changing capability for realizing growth—an appreciating asset that fuels long-term competitive advantages.

In the upcoming series of articles, we will delve into the fundamentals of constructing a robust playbook for growth and formulating game plans for sustainable, repeatable success.

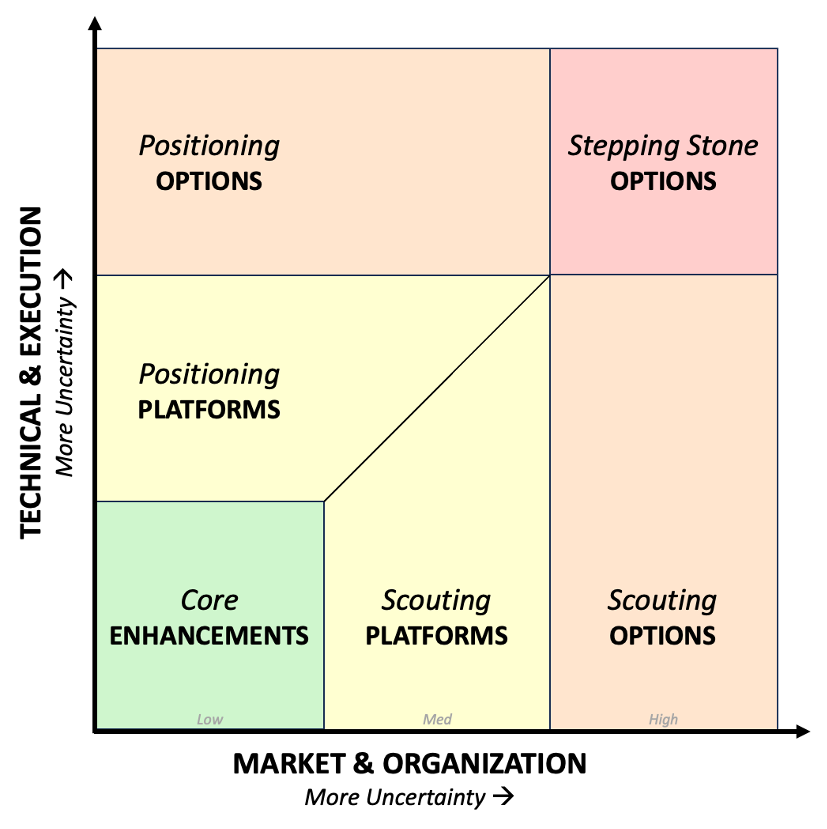

This article serves as an introduction to the 'top of the house.' The growth portfolio map emerges as a singular, straightforward, and visual capability encapsulating the 50,000-foot view of the growth playbook. For stakeholders with an unwavering desire to win, this living map of the growth game plan must consistently hold a place among the top three topics in leadership discussions.

The Growth Portfolio Map adapted from Discovery-Driven Growth

This methodology is derived from my go-to reference, Rita McGrath's "Discovery-Driven Growth." The Growth Portfolio Map helps organizations strategically navigate the complexities of innovation and growth. Central to this framework are two critical axes:

Market & Organization Uncertainty

Technical & Execution Uncertainty

…and six components of a balanced growth strategy, each with different goals, risk profiles, and management approaches:

Core Enhancements

Positioning Platforms

Scouting Platforms

Positioning Options

Scouting Options

Stepping Stone Options

Let’s break these down.

Understanding the Axes - Characterizing Uncertainty

1. Market and Organization Uncertainty:

Market Uncertainty: Refers to uncertainties related to the demand for a product or service in the target market. This involves uncertainties about customer preferences, market size, and the competitive landscape. For example, a company entering a new market with a unique product may face uncertainty about how well the product will be received by customers or how large the market actually is.

Organization Uncertainty: Relates to uncertainties within the organization, such as its capabilities, resources, and structure. It involves questions about whether the organization has the necessary skills, resources, and flexibility to adapt to changes in the market to deliver value to consumers. An example could be a company entering a new market with a new type of customer that requires a completely different set of skills or resources than what the organization currently possesses.

2. Technical and Execution Uncertainty:

Technical Uncertainty: Involves uncertainties related to the technology or processes required to develop and deliver a product or service. This could include uncertainties about the feasibility of a new technology, potential technical challenges, or the need for further research and development. For instance, a company developing a cutting-edge technology may face uncertainties about its reliability or scalability.

Execution Uncertainty: Refers to uncertainties related to the successful implementation of the business strategy. It involves questions about the ability of the organization to execute its plans effectively, including issues related to project management, coordination, and resource allocation. An example could be a company launching a new product but facing challenges in effectively coordinating marketing, production, and distribution efforts for an unfamiliar technology.

The Components of a Balanced Growth Playbook

1. Core Enhancements:

Core Enhancements are growth initiatives that incrementally build upon a business model that is already successful, diversifying, and increasing its competitiveness.

The organization already has a clear understanding of the market, its products, and possesses the capability to implement. These projects are able to be planned and executed with conventional management methods and tools.

While returns on these innovations can be substantial, most provide incremental gains in revenue while increasing profitability but are fast to market and inherently low risk.

What are New Platforms?

New platforms are major initiatives that represent a substantial investment in growth that aim to build new foundations for future growth and generate near-term returns.

These programs could be managed with conventional methods and tools, but need to blend with learning-based methods because the moderate uncertainties about the market and technologies coupled with the emphasis on the short term can shadow vulnerabilities and impact the odds of success.

Generally new platforms require new lines of business that have to share resources with the established business, and special attention is necessary to ensure alignment of incentives and resources.

2. Positioning Platforms:

Positioning Platforms target well understood core or core-adjacent markets with new products and services that leverage current assets and technologies.

The organization has a portfolio of concepts or products in development, but it remains uncertain in how to position in the market with a profitable business model.

Successful positioning of new products or services can establish entirely new categories for growth at scale, especially when coupled with the access and experience in already well understood markets.

3. Scouting Platforms:

Scouting Platforms leverage successful business models with legacy or new products and services to target new and unfamiliar markets where the organization has limited operating experience.

While there may be confidence in the success of these offerings, it remains uncertain which markets can be successfully penetrated and if the company can adapt to operating in new markets.

Successful scouting initiatives not only produce an new market entry to cross-pollinate and scale with new customers, but also builds capability to penetrate into other unfamiliar markets.

What are Options?

Real options, or “seeds,” are incremental investments in learning to gain access to potentially game changing future opportunities that have substantial upside.

The fundamental principle is making incrementally larger investments to increase the value of the option by reducing uncertainties and creating asymmetry between risk and reward at each stage.

Imposing conventional planning, management, and budgeting systems will not be effective in this arena of high uncertainties, such as attempting to calculate net present value or discounted cash flows when many of the details are based on uninformed assumptions.

4. Positioning Options:

Positioning Options target areas where the organization is fairly confident in the long-term customer demand and market trends, substantiating investments to pursue new capabilities or technologies.

Generally these technologies are relatively mature and the organization already possesses the capability to pursue and leverage them, but it is unknown how the customer demand will be addressed and how a business model would capture adequate value to justify future investments.

Often an organization may become aware of news or trends where other companies are making long-term bets to pursue potential solution spaces and realize without also making investments their current market position could be in jeopardy in the future.

Positioning options serve two main strategic purposes:

Hedge future risks which could render the core business unable to compete

Provide a safe environment to discover business concepts that emerge from leveraging the new technologies while reducing uncertainty about the financial viability and the feasibility to execute

5. Scouting Options:

Scouting Options seek to find new markets for a solution that either is already commercialized or relatively well defined.

These solutions range from extensions of existing core businesses, new platforms, solutions that can be obtained through partnerships or M&A, or even internal capabilities which the organization has expertise and the ability to commercialize.

A company may have a portfolio of potential value propositions and target markets, but the value proposition, the respective opportunity, and the organizational feasibility to produce are unknown.

Scouting options serve two main strategic purposes:

Increase returns on existing strategic assets to fuel growth

Provide a safe environment learn and experiment with new markets and customers to discover future platforms for growth around competencies

6. Stepping Stone Options:

Stepping Stone Options are investments in learning that a business believes can strategically transform the business in the future.

They target inflection points defined by the intersection of market trends and emerging technologies that can change what is possible in the service of customers getting the jobs they would like to get done in their lives.

An organization makes these investments in the future to discover opportunities for blockbuster growth and to avoid getting left behind.

The high tech and market risk inherently represent that the organization doesn’t currently possess the capability and understanding to realize these options in the short term, but seeks to learn insights about what, when, and how before competition.

Final Thoughts - A Growth Game Plan & Playbook is continuously building an asset, not a one time project

When approached as a continuous asset-building initiative, developing a growth portfolio map becomes a powerful tool for achieving long-term competitive advantages. It transcends the limitations of a one-time project by fostering a culture of innovation, agility, and strategic adaptation. As organizations consistently revisit and enhance their growth playbook, they not only navigate uncertainties more effectively but also position themselves as industry leaders capable of sustaining success over the long haul. In essence, it transforms growth from a singular objective to an enduring journey—a testament to the organization's commitment to staying ahead of the game.

Comments